Board Discussion and Vote on Prop I

-

Below, community members can watch the section of the May 16, 2023 Board of Education meeting where the Board discussed and voted to add Prop I to the August 8, 2023 ballot.

-

The Fox C-6 Board of Education voted unanimously at its May 16, 2023 meeting to place a tax levy increase on the August 8, 2023 ballot. Proposition I will allow Fox C-6 to remain competitive with neighboring districts in staffing and program offerings while being mindful of our community’s current investment in our schools.

Prop I Town Hall Meeting Video

-

Throughout the summer, Fox C-6 held a series of town hall meetings to inform voters of district finances and to answer questions regarding Prop I. Below is video from the two town hall meetings that were held at the Fox C-6 Service Center.

Property Tax Calculator

-

Use the calculator below to determine an estimate of what Prop I would cost. Residents routinely overestimate the appraised value of their homes. Visit the Jefferson County Assessor’s website to view your home’s appraised value. Once you have found your home, select “2022” from the drop-down menu and scroll down to “Assessments”, to review the “Prior Year Appraised Total”. This is the number to enter into the calculator below.

Printable Prop I Flyer

-

Prop I Printable Flyer

Use this link to download, print, and share Prop I and Fox C-6 information with family, friends, and neighbors.

Prop I Frequently Asked Questions

-

What is Proposition I?

Proposition I is a proposal on the August 8, 2023, ballot asking voters who live within Fox C-6 School District to consider an operating levy increase of 92.07 cents per $100 of assessed valuation. The operating tax rate increase would allow the District to continue to offer consistent, competitive academic programming and competitive salaries for all staff members, as well as avoid additional budget reductions.

-

Why is Prop I needed?

Fox C-6 currently has the second lowest total tax rate of all school districts in Jefferson County and St. Louis County. The district relies on local taxes for 51.53% percent of its budget. Historic levels of inflation along with a low tax rate make it difficult for Fox C-6 to continue to be competitive with neighboring school districts in terms of staffing and program offerings.

-

How much will Prop I cost me?

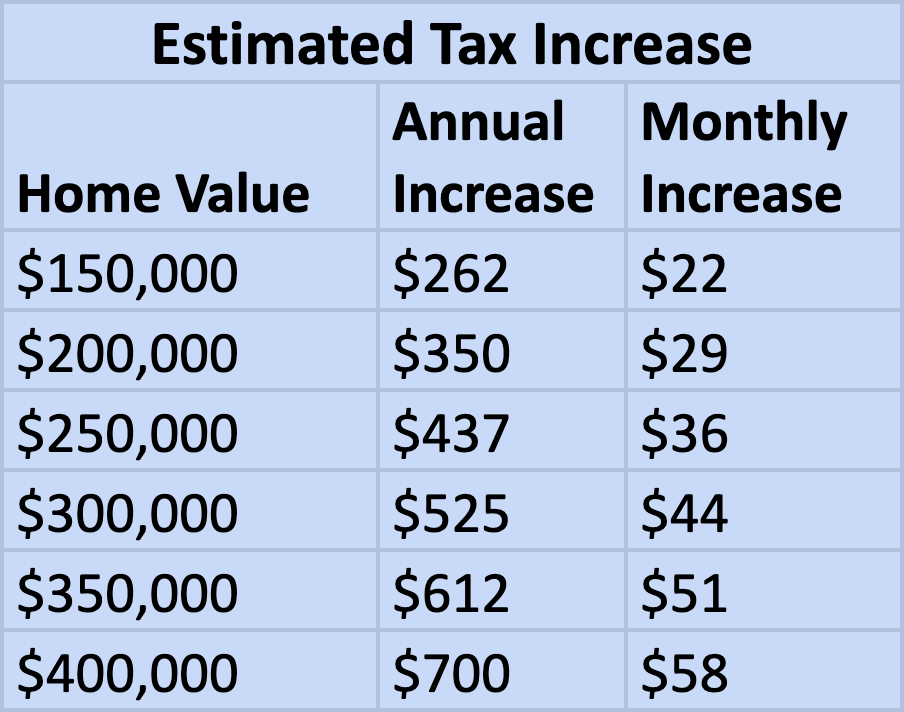

Prop I is an operating tax rate increase of 92.07 cents for each $100 of assessed value. This means the average annual tax increase for the owner of a $200,000 home would be approximately $350 per year, or just under $29 per month. The increase in taxes for an owner of a $300,000 home would be approximately $525 per year or about $44 per month. (Note: the figures in the chart below are estimated annual and monthly tax increases and are rounded to the nearest whole dollar.)

-

Is the proposed tax levy increase only for real estate taxes?

Voter approval of Proposition I would increase real estate tax and personal property tax by $0.9207. Since personal property varies by household, it is difficult to provide an estimate of its increase.

-

What happens if Prop I passes?

Voter approval of Prop I would allow the District to continue to invest in high-quality learning, activities, and programs for students and competitive salaries for all staff members, as well as avoid additional budget reductions.

- Recruit and retain highly qualified certified and operational staff that have a direct impact on the success of our students each day.

- Maintain a wide variety of innovative course offerings and a variety of programs for our students to prepare them for the workforce.

- Continue to staff our schools at or below the DESE (Department of Elementary and Secondary Education) recommendations.

-

What happens if Prop I fails?

Without the added revenue generated by Prop I, Fox C-6 would face difficult financial decisions including:

- Reducing academic program offerings that could include elective courses at the middle school and high school

- Larger class sizes to further reduce staffing numbers

- Fewer extracurricular sports and activities for students

- An overall decline in the quality of education the district can provide

-

How does Fox C-6 get its funding?

How does Fox C-6 get its funding?

A: Fox C-6 receives the majority of its funding from local revenue and the state of Missouri's school funding formula. The chart below shows this breakdown.

-

Can Fox C-6 cut its budget to prevent the need for a tax increase?

Currently, Fox C-6 has one of the lowest total tax rates of all school districts in Jefferson County and St. Louis County, ranking 32nd out of 33 school districts. Additionally, our expense per student, which represents normal daily operating expenses, is one of the lowest in the area as well, rating 31st out of 33 school districts. For the 2023-2024 school year, Fox C-6 has reduced its budget by approximately $5 million through:

- reduction of staff through attrition, saving approximately $2.4 million

- re-allocating 15 cents from the district's debt services levy to the operating levy to add $1.8 million to the operating budget

- delaying a Chromebook refresh cycle to save $500,000

- reducing building and department budgets by approximately $250,000

Jefferson County/St. Louis County Total Tax levy Rank DISTRICT NAME Total Levy 1 RIVERVIEW GARDENS $ 8.6080 * 2 JENNINGS $ 7.1384 * 3 HAZELWOOD $ 7.0685 * 4 NORMANDY $ 6.6712 * 5 MAPLEWOOD $ 6.5148 * 6 AFFTON 101 $ 6.1261 * 7 HANCOCK PLACE $ 6.1086 * 8 FERGUSON-FLORISSANT R-II $ 6.0573 * 9 RITENOUR $ 6.0081 * 10 PATTONVILLE R-III $ 5.9382 * 11 VALLEY PARK $ 5.9050 * 12 BRENTWOOD $ 5.6423 * 13 UNIVERSITY CITY $ 5.5251 * 14 WEBSTER GROVES $ 5.5088 * 15 BAYLESS $ 5.3786 * 16 CLAYTON $ 5.3692 * 17 ROCKWOOD R-VI $ 5.1410 * 18 KIRKWOOD R-VII $ 5.0304 * 19 PARKWAY C-2 $ 5.0190 * 20 LINDBERGH SCHOOLS $ 4.8434 * 21 DUNKLIN R-V $ 4.8198 22 WINDSOR C-1 $ 4.7635 23 LADUE $ 4.7094 * 24 GRANDVIEW R-II $ 4.6777 25 CRYSTAL CITY 47 $ 4.6768 26 MEHLVILLE R-IX $ 4.6756 * 27 JEFFERSON CO. R-VII $ 4.5967 28 HILLSBORO R-III $ 4.5679 29 SUNRISE R-IX $ 4.5555 30 NORTHWEST R-I $ 4.4900 31 DESOTO 73 $ 4.3853 32 FOX C-6 $ 4.2526 33 FESTUS R-VI $ 4.0856 DESE Data as of November 2022* St. Louis County Districts' levies include the SSD tax levy of $1.0158 for accurate comparison. -

Can Fox C-6 use its reserve funds to prevent the need for a tax increase?

Based on projections from the Missouri Department of Elementary and Secondary Education, Missouri schools are expecting to see a steep reduction in state aid in the coming years. This reduction, along with historic inflation rates, may require districts to dip into their reserve funds to cover operating expenses.

-

Didn’t the community just approve a tax increase?

No. Fox C-6 voters have not approved an operating tax increase since 2004. In June of 2020, Fox C-6 voters approved a $40 million no-tax rate increase bond issue to be used for facility improvements, along with safety and security upgrades. Bonds cannot be used to pay for the day-to-day operating costs of a school district.

-

When was the last time Fox asked for an operating tax increase?

The last operating tax levy increase was passed by Fox C-6 voters in 2004, 19 years ago. That means that students who graduate in the class of 2023 had the same operating tax levy when they were in kindergarten as they do this year, their senior year, despite increased operating costs. In 2017, Fox put Prop S, a $70 million bond on the ballot, which would have increased the tax rate; however, it did not pass.

-

Why can’t you use the bond money approved in 2020 to address the current budget deficit?

Think of it this way: bonds are for buildings, and levies are for learning. Bond funds can only be used for capital improvement projects such as building additions and safety improvements. Operating levies are used for salaries, instructional materials, and other day-to-day operating expenses.

-

How can Fox have such a budget deficit? District finances look good right now.

There are several factors that are contributing to the District’s financial situation. A state funding cliff faces districts that rely heavily on state funding. This funding cliff will result in at least $5 million less in state funding per year for our district. Fox C-6, like other districts, has seen the impact of inflation which impacts our daily operating costs.

-

Why can’t the district operate with the taxes we already pay? Why do you need additional funding?

Operating costs increase for schools every year. Without an increase in the revenue we receive, it is difficult to maintain high-quality schools for our students, families, and community.

-

How much does Fox spend per pupil each year? How does that compare to other schools in the region?

Out of 33 St. Louis County and Jefferson County school districts, Fox C-6 ranks 31st in per-pupil expenditures at $10,232.87 per student. The average per-pupil expenditure in our area is $12,996.55.

Jefferson County/St. Louis County

Expense Per StudentRank District Name Expenditures per Student 1 CLAYTON $ 21,397.56 2 BRENTWOOD $ 20,734.15 3 UNIVERSITY CITY $ 18,500.49 4 NORMANDY SCHOOLS COLLABORATIVE $ 17,308.11 5 MAPLEWOOD-RICHMOND HEIGHTS $ 15,808.70 6 VALLEY PARK $ 14,984.41 7 HANCOCK PLACE $ 14,953.32 8 LADUE $ 14,911.47 9 PATTONVILLE R-III $ 14,360.37 10 FERGUSON-FLORISSANT R-II $ 13,967.50 11 KIRKWOOD R-VII $ 13,263.32 12 WEBSTER GROVES $ 12,993.80 13 PARKWAY C-2 $ 12,837.39 14 GRANDVIEW R-II $ 12,561.52 15 AFFTON 101 $ 12,414.22 16 HAZELWOOD $ 12,402.46 17 DUNKLIN R-V $ 12,279.09 18 RITENOUR $ 11,965.02 19 JEFFERSON CO. R-VII $ 11,808.36 20 ROCKWOOD R-VI $ 11,509.50 21 CRYSTAL CITY 47 $ 11,381.23 22 BAYLESS $ 11,136.37 23 NORTHWEST R-I $ 10,956.24 24 SUNRISE R-IX $ 10,911.71 25 MEHLVILLE R-IX $ 10,903.04 26 LINDBERGH SCHOOLS $ 10,829.92 27 WINDSOR C-1 $ 10,778.03 28 DESOTO 73 $ 10,733.94 29 RIVERVIEW GARDENS $ 10,363.86 30 JENNINGS $ 10,287.77 31 FOX C-6 $ 10,232.87 32 HILLSBORO R-III $ 9,853.40 33 FESTUS R-VI $ 9,556.94 DESE Data as of November 2022 -

How will Prop I appear on the ballot?

Shall the School Board of the Fox C-6 School District of Jefferson County, Missouri, be authorized to increase the operating tax levy for the purposes of maintaining and upgrading school buildings and classrooms, purchasing school supplies and technology and for compensation for District employees, and other operating expenses, by Nine Thousand Two Hundred and Seven Ten Thousandths Cents ($0.9207) per one hundred dollars of assessed valuation.

If this proposition is approved by the voters, the adjusted operating levy of the Fox C-6 School District is estimated to be Four Dollars and Seven Thousand Nine Hundred and Twenty-Three Ten Thousandths Cents ($4.7923) per one hundred dollars of assessed valuation.

-

How does Fox’s tax levy compare to other schools in the region?

Out of 33 St. Louis County and Jefferson County school districts, Fox C-6 ranks 32nd in total tax levy with $4.2526 per $100 of assessed value.

Jefferson County/St. Louis County Total Tax levy Rank DISTRICT NAME Total Levy 1 RIVERVIEW GARDENS $ 8.6080 * 2 JENNINGS $ 7.1384 * 3 HAZELWOOD $ 7.0685 * 4 NORMANDY $ 6.6712 * 5 MAPLEWOOD $ 6.5148 * 6 AFFTON 101 $ 6.1261 * 7 HANCOCK PLACE $ 6.1086 * 8 FERGUSON-FLORISSANT R-II $ 6.0573 * 9 RITENOUR $ 6.0081 * 10 PATTONVILLE R-III $ 5.9382 * 11 VALLEY PARK $ 5.9050 * 12 BRENTWOOD $ 5.6423 * 13 UNIVERSITY CITY $ 5.5251 * 14 WEBSTER GROVES $ 5.5088 * 15 BAYLESS $ 5.3786 * 16 CLAYTON $ 5.3692 * 17 ROCKWOOD R-VI $ 5.1410 * 18 KIRKWOOD R-VII $ 5.0304 * 19 PARKWAY C-2 $ 5.0190 * 20 LINDBERGH SCHOOLS $ 4.8434 * 21 DUNKLIN R-V $ 4.8198 22 WINDSOR C-1 $ 4.7635 23 LADUE $ 4.7094 * 24 GRANDVIEW R-II $ 4.6777 25 CRYSTAL CITY 47 $ 4.6768 26 MEHLVILLE R-IX $ 4.6756 * 27 JEFFERSON CO. R-VII $ 4.5967 28 HILLSBORO R-III $ 4.5679 29 SUNRISE R-IX $ 4.5555 30 NORTHWEST R-I $ 4.4900 31 DESOTO 73 $ 4.3853 32 FOX C-6 $ 4.2526 33 FESTUS R-VI $ 4.0856 DESE Data as of November 2022* St. Louis County Districts' levies include the SSD tax levy of $1.0158 for accurate comparison. -

When can I learn more about Prop I?

Fox C-6 will host a series of town hall meetings as the August 8, 2023 election approaches. Scheduled town hall meetings are below.

Town Hall Meeting Schedule

June 1, 6:30 pm

George Guffey Elementary SchoolJune 15, 6:30 pm

Antonia Middle SchoolJuly 19, 6:30 pm

Fox C-6 Service Center